When an entrepreneur is starting to think about attracting external investments he/she faces a problem of developing a business plan. Without it there’s no reason of meeting with investors because, surely, no decision will be made. It’s a common misconception (especially in the pre-startup phase) that there is no point of creating a business plan. And if it is still to be created it could be formal and contain nothing but generalities. No wonder such entrepreneurs usually end up with no investments. The majority of investors will look through your business plan very thoroughly. Your ROI calculations are not even their first interest as what they are looking for is your deep understanding of the market you are going to address with your product or service and whether your product / service will enjoy a good demand to eventually bring profit to the startup. That’s why you should take your business plan development seriously. This document is a kind of a check list for a startup entrepreneur to understand whether he/she has made a sufficient market research and has got a well thought-out project. I personally create a business plan with all calculations for each of my new project even if I have no intention of attracting funds from outside investors. I do it for myself, for better understanding of what I want to get, what I have to do to reach my goals and whether I can handle the project by my own or have to partner with someone. In 99% of cases the initial calculation that seemed sufficient for the project implementation would increase 2-3 times after a more thorough consideration of some small but important details every business consists of.

However startup business plans that appeal to venture capitalists are a bit different from standard business plans one can find in the Internet. First of all, it’s because angel investors prioritize some other things. That’s why the structure of the business plan you’ll find below meets the requirements of venture funds.

Market and Industry

1.1 Market Prospects

In this paragraph an entrepreneur describes the market for the offered product or service. It’s advisable to show the existing market dynamics and make a forecast on the growth potential, changes and development of the market. If you have an access to any professional researches of the market opportunities for your product or service you should provide a reference to such materials. Here you should also describe important trends and events that are happening or going to happen on your market.

1.2 Market Size, Segment and Potential Customers

1.2.1 Potential Customers

In this clause you should provide detailed information on potential customers of the offered product or service. If it’s an end product or service for retail customers your investors would like to see the customers’ consumption and income pattern (the size with a breakdown by countries/regions). In case of B2B sales it’s advisable to provide such data as the potential customers’ market share, annual turnover (if available), share of the offered product in the these businesses’ consumption patterns and their business development tendency.

1.2.2 Offered Product or Service Market Segment

By the offered product or service segment we mean the niche that the product fills or is going to fill on the market.

1.2.3 Market Size and State

This clause is for description of the size, state and capacity of the existing market for your product or service.

1.3 Competition

Here you should describe your startup competition on the existing market, list and describe all the manufacturers/providers of competing products or services.

1.3.1 Direct Competition

In this clause a would-be startup founder demonstrates and describes all products or services that can compete directly with the startup product or service. The entrepreneur’s product or service should also be compared product with its existing or future competitors.

1.3.2 Alternative Competition

Unlike the previous Direct Competition clause you should indicate hereby your possible alternative competitors.

1.3.3 Competitive Advantages

Competitive advantages are key components of the project success that’s why you need to do your best to thoroughly describe all competitive advantages of your product or service.

For example:

- A patented proprietary technology or process. Unique experience and know-how acquired by business/managers/experts.

- High-end, unique equipment.

- Special properties of the product or service.

- Exclusive contracts.

- A wide distribution network.

1.3.4 Barriers and Obstacles

Here the entrepreneur should indicate the existing market entry barriers as well as protective barriers that help hold the expected product/service share on the market. You’ll also need to add information on barriers that are to be put up to protect your project from competitors.

Product and Technology

2.1 Technology

In this clause you need to give a thorough description of your technology, its advantages and main components.

2.2 Technology Improvement Work

You should provide here some information on the current technology improvement work.

2.3 Product

2.3.1 Product peculiarities

This clause is for the detailed description of the product you’re addressing the market with. You should also show here your product main peculiarities and distinctiveness from the competitive products offered on the market.

2.3.2. Product Sales Channels and Opportunities

Here your should indicate the main sales channels for your product or service.

For example:

- Products distribution method.

- Suggested distributors and resellers.

- Research data on the potential demand.

2.3.3 Direct use peculiarities

Here you should describe all direct use peculiarities of your product or service.

For example:

- Outstanding features

- Flaws

- Hidden potential

2.3.4 Alternative use possibilities

This part of the business plan is for proving information on possible alternative ways to use your product.

For example:

- Outstanding features

- Flaws

- Hidden potential

Intellectual Property and Its Protection

3.1 Intellectual Property

Here you should describe your project intellectual property that is to be protected.

3.2 Actual Intellectual Property Protection

In this clause you should list all the patents you have, including the filed PCT applications.

3.3 Plans for Further Protection

If according to the project authors there are some parts of the project that are not backed up with patents, you should provide information regarding your plans for the future intellectual property protection.

For example:

- Patent search.

- Filing missing patent applications in your own or other countries.

Team

4.1 Managing team

Here you should describe your managing team in details:

- Short bio of your key managers.

- Their relevant experience and achievements.

- Contacts and references from the companies and employees related to the venture capital fund.

- Each top-manager’s motivation in the business.

4.2 Technology Development Team

In this clause you need to provide some data on your technology development team in the same way you did with the managing team.

4.3 Prospective Management Team Reinforcement

Managers availability or hiring opportunities:

- Chief Executive Officer

- Chief Operating Officer

- Chief Strategy Officer

- Chief Financial Officer

- Chief Accountant

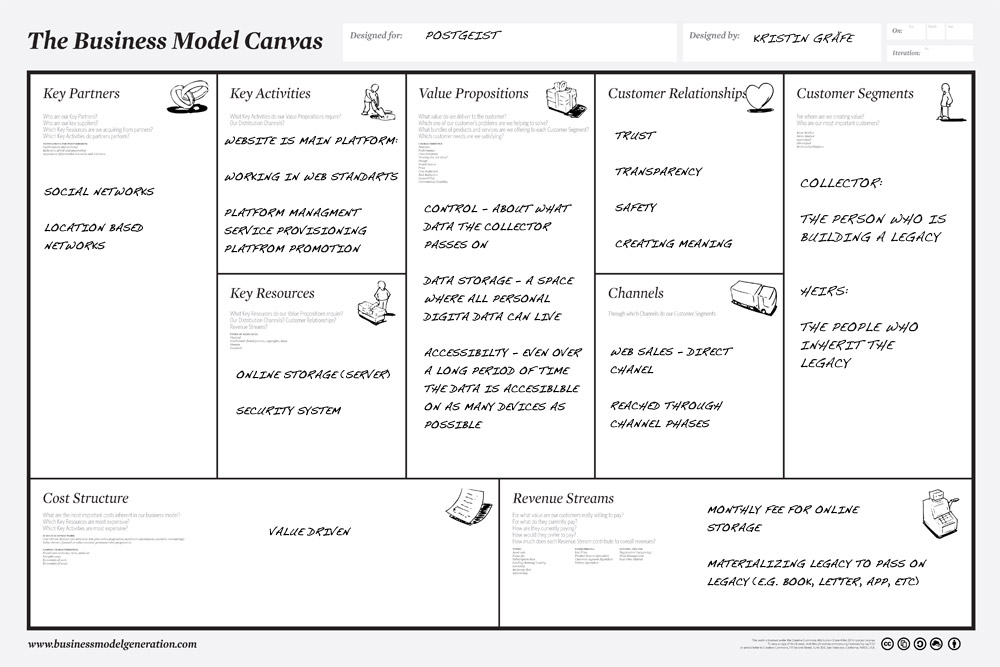

Business Model

Here you should describe your current or prospective business model.

5.1 Operations and Strategy

5.1.1 Research & Development

In the R&D clause a startup entrepreneur provides some information on the project research component as well as the ongoing and expected development.

5.1.2 Production

The “production” notion here comprises the following:

- Buildings, structures and titles to land.

- Main equipment, its cost and depreciation.

- Necessity and amount of investment for improvement and repair.

5.1.3 Customer Service

Customer service here is the necessity and structure of work with clients that have already become consumers of your product or service.

5.2 Product Promotion Strategy

5.2.1 Marketing Campaigns

Here you should describe your planned marketing campaigns and key marketing activities targeted at your product end users.

5.2.2 Evaluated Marketing Campaign ROI

This clause is for the marketing campaigns cost-effectiveness evaluation. Here are some things you should try to predict and describe are:

- Marketing investments dynamics / ROI per client.

- Dynamics of a single client response to a specific marketing component.

- Expected actions for marketing campaigns effectiveness tracking and analysis.

5.3 Sales Development Strategy

5.3.1 Main Sales Channels

In this clause startup entrepreneurs should describe the promotion strategy of their products or services in the main sales channels, the way they are going to work with distributors and suppliers.

5.3.2 Alternative Sales Channels

This clause is similar to the previous one but deals with alternative sales channels.

5.3.3 Basic Sales Concept

Here you should describe a basic concept of your product or service promotion in the distribution network or to a certain type of customers.

5.4 Implementation Schedule

5.4.1 Prospective Market Entry Schedule

Here you should define your maximum capitalization schedule as well as represent your vision of the venture capitalist’s exit from the project.

5.4.2 Key Milestones

This clause is necessary for scheduling the most important events in the future the project lifetime.

Finances

6.1 Key Assumptions

6.1.1 Sales Forecast

Here you should describe main statements on which the sales forecast is based and put in appropriate calculations.

6.1.2 Operating and Capital Costs

In this clause you should describe all prospective operating and capital costs in accordance with the sales plan and key milestones.

6.2 Consolidated Financial Forecast

Here startup founders show the company’s consolidated financial forecast beginning the time of getting the VC funding.

Project Risks

Project risks hereby should be understood as:

- Industry development stages, its current condition and forecasts.

- Factors influencing sales increase / decrease and pricing in the industry.

- Dependence on other industries, the threat of product substitution.

- The State’s role (regulations, licensing).

Investment and Exit Strategy

8.1 Amount of Requested Investments

Here you need to indicate the amount of requested funds and investment time period.

8.2 Investment Composition and Consumption Schedule

This clause suggests the description of the requested investment composition as well as consumption rate and payoff for each point of the investment composition.

8.3 Prospective Exit Strategy

Here you should detail investor’s project exit options:

- The structure of a prospected deal and participation of the VC fund.

- Description of business exit options for the VC fund (IPO, sale to a strategic investor etc.)

- Potential buyers and their motivation.

- Availability of an option for a VC fund to purchase a share of the startup company.